All Categories

Featured

Table of Contents

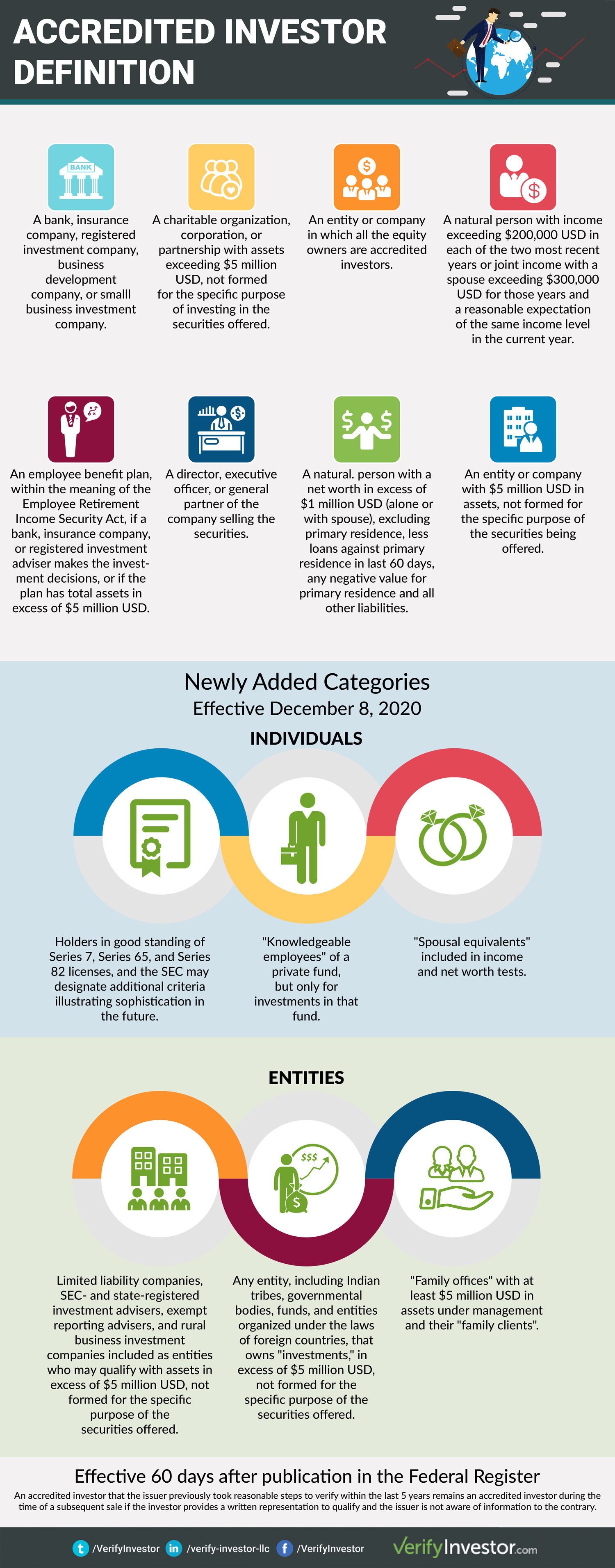

Start-ups are dangerous ventures with a high opportunity of failure. The certified financier limitation tries to make sure that only financiers with the enough means to absorb a full loss and the sophistication to recognize that danger are enabled to invest. Capitalists just have to fulfill the requirements defined in Rule 501(a) of Policy D of the Stocks Act of 1933 to be taken into consideration a certified financier.

Therefore, there are a lot of entities that can get me to checklist right here (and plus it would certainly birthed you to death). Generally, for an entity to qualify as an accredited capitalist it needs to be a defined entity that is regulated, such as a financial institution, insurer, financial investment business, financial investment expert, or broker-dealer, or it has assets or investments going beyond $5 million and it had not been formed for the purpose of getting the protections being provided, or every one of its equity owners are accredited capitalists.

Talk to your attorney regarding which exceptions use in your case. The most typically used exceptions entail sales to accredited financiers, yet the steps you are required to require to confirm the condition of your investors can differ based upon the particular exemption you mean to make use of. At a minimum, your financiers ought to confirm that they are accredited capitalists.

Fidelity has actually made an available for you to utilize with your capitalists. If you are elevating funding through the sale of safeties to recognized investors, you most likely likewise require to file paperwork associated to your exemption - are you an accredited investor. This is likely to entail a Kind D declaring with the SEC (called for within 15 days of your first sale) and a testimonial of state policies in each state the offering is made

Definition Of Accredited Investor 2020

This recap is intended to give a fast referral for potential members, but does not make up legal guidance and may run out date at any kind of moment. Each member of Toniic bears responsibility for ensuring its compliance with the financier certification demands of every jurisdiction to which that participant is subject.

Along with regulations bordering public offering, PRC laws manage Chinese outbound financial investments. PRC laws and regulations have not provided the specific procedures for Chinese private investors to make their financial investments in any non-financial entities integrated outside China. Consequently, presently only Chinese corporate capitalists may be able to buy an international venture.

Usually, an outgoing purchase has to be approved by, or submitted with, the National Growth and Reform Commission (NDRC), the Ministry of Commerce (MOFCOM), and State Management of Foreign Exchange (RISK-FREE), or their regional counterparts. If State-owned business are entailed, the authorization of the State-owned Properties Supervision and Administration Commission may likewise be called for.

September 3, 2020 By: Robert A. Greising,, and Corben A. Lee On August 26, 2020, the Stocks and Exchange Payment (the "SEC") taken on changes (the "Changes") to the exclusive positioning meaning of "accredited capitalist" in Policy D under the Securities Act of 1933 (the "Stocks Act"). The SEC's key purpose of the Changes is to increase the swimming pool of recognized investors to include investors that have the knowledge and proficiency to assess the risks of illiquid privately provided protections.

Falsely Claim Accredited Investor

The SEC considers this an explanation, instead of an expansion, as it intended that Guideline D show its historical SEC staff interpretations that LLCs were eligible to be accredited investors if they fulfilled the other requirements of the definition. If you wish to review the effects of the Amendments to your service or have inquiries, please call,,, or any kind of other participant of our.

So, now you understand what qualifies you as an approved financier, you require to determine if you fit the requirements. As mentioned over, you require to have a web worth that goes beyond $1 million as an individual or joint with your spouse to be taken into consideration accredited. You might not include your primary residence in your.

Accredited Investor Platforms

If the loan on your primary residence is more than the fair market value of the residence, then the financing quantity that is over the reasonable market value counts as an obligation in your net well worth calculation. Additionally, if there is a boost in the loan amount on your primary home within 60 days of investing, it will additionally count as obligation.

When determining your net worth, groups might ask you for economic statements, tax returns, W2 kinds or other documents that show earnings. While there is no federal government law of every private recognized financier; there are strict laws from the needing companies like exclusive equity funds, hedge funds, venture funding companies, and others to take a number of steps to confirm the status of a financier prior to dealing with them.

In 2020, an approximated 13.6 million united state families are approved capitalists. These households control massive wealth, estimated at over $73 trillion, which represents over 76% of all exclusive wide range in the united state. These capitalists participate in financial investment chances usually not available to non-accredited capitalists, such as financial investments secretive companies and offerings by particular hedge funds, personal equity funds, and venture capital funds, which enable them to expand their wealth.

Read on for details about the most recent certified investor revisions. Banks usually money the bulk, however rarely all, of the capital called for of any acquisition.

There are largely 2 guidelines that allow providers of protections to supply endless amounts of securities to investors - how to become an accredited investor. One of them is Policy 506(b) of Regulation D, which permits a provider to offer safety and securities to unrestricted recognized investors and approximately 35 Sophisticated Financiers only if the offering is NOT made with general solicitation and basic marketing

Qualified Investment

The newly adopted changes for the very first time accredit specific financiers based upon financial refinement needs. A number of various other amendments made to Rule 215 and Regulation 114 A clear up and expand the checklist of entity kinds that can qualify as a certified financier. Here are a few highlights. The modifications to the accredited investor interpretation in Regulation 501(a): consist of as certified investors any kind of trust, with total properties much more than $5 million, not created especially to purchase the subject securities, whose acquisition is routed by an innovative person, or consist of as certified financiers any kind of entity in which all the equity owners are certified investors.

And currently that you recognize what it implies, see 4 Realty Advertising methods to bring in certified investors. Web Site DQYDJ Article Investor.gov SEC Proposed amendments to definition of Accredited Capitalist SEC modernizes the Accredited Capitalist Meaning. Under the federal safety and securities regulations, a company may not supply or sell securities to capitalists without enrollment with the SEC. There are a number of registration exceptions that inevitably expand the cosmos of possible financiers. Several exceptions need that the investment offering be made just to individuals that are accredited financiers.

Furthermore, accredited financiers commonly obtain extra favorable terms and higher potential returns than what is readily available to the general public. This is because private placements and hedge funds are not called for to comply with the very same regulative requirements as public offerings, enabling even more versatility in terms of investment methods and prospective returns.

One reason these protection offerings are limited to accredited capitalists is to ensure that all getting involved financiers are financially innovative and able to fend for themselves or sustain the threat of loss, hence providing unneeded the defenses that come from a registered offering.

The internet worth test is fairly simple. Either you have a million dollars, or you don't. However, on the revenue test, the individual should please the thresholds for the 3 years constantly either alone or with a spouse, and can not, as an example, satisfy one year based upon specific income and the next 2 years based on joint revenue with a spouse.

Table of Contents

Latest Posts

Tax Lien Investing Scams

Excess Funds List

Tax Lien Foreclosure Properties

More

Latest Posts

Tax Lien Investing Scams

Excess Funds List

Tax Lien Foreclosure Properties